My Money Pyramid

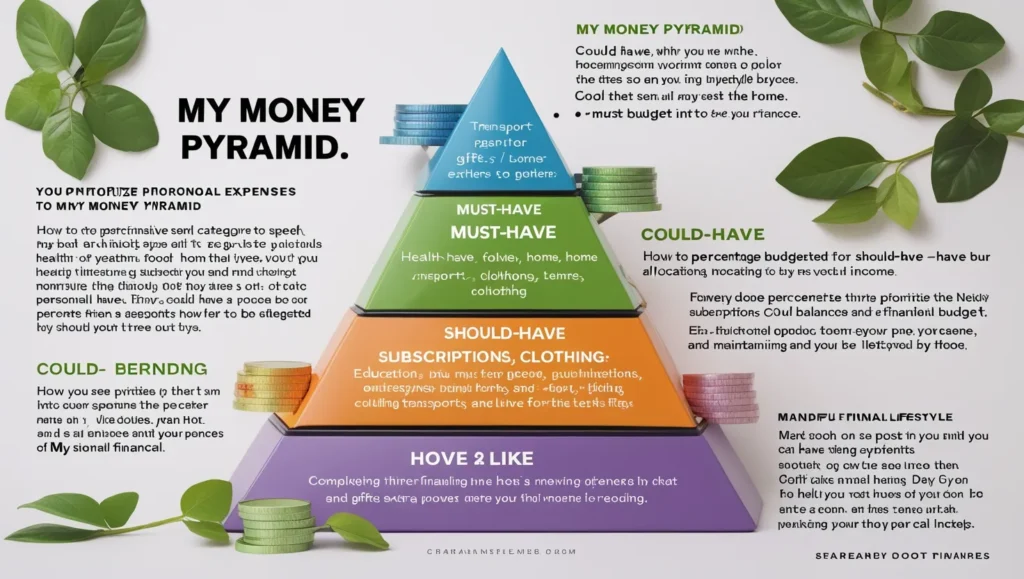

Managing money wisely is one of the most empowering habits anyone can cultivate. Over time, I’ve developed a personal system that helps me make financial decisions with clarity and purpose. I call it “My Money Pyramid”—a simple yet powerful way to prioritise spending based on what truly matters in life.

At its core, this pyramid is built on three levels of importance: Must-Haves, Should-Haves, and Could-Haves. Each layer represents a different category of expenses, arranged by how essential they are to my survival, growth, and enjoyment of life. Let’s walk through the pyramid, starting from the base.

1. The Foundation: MUST HAVE

The base of my pyramid includes the essentials—expenses that are absolutely non-negotiable. Without them, daily life would come to a standstill. These costs form the My Money Pyramid backbone of my financial planning and are the first to be covered each month.

Health

Health is the true wealth. Whether it’s medical insurance, doctor visits, medicines, or fitness costs, this category gets the highest priority. I ensure that I have regular check-ups and emergency funds to address any unexpected health issues. Preventive care is also a key part of this—exercise routines, mental wellness, and healthy food all fall under this umbrella. If your body and mind aren’t well, nothing else matters.

Home

Rent or mortgage payments, utilities, maintenance, and basic furnishings go under this category. Having a safe and stable home provides the foundation for everything else in life. I treat housing as a core investment—not just in bricks and walls, but in My Money Pyramid peace of mind.

Transport

Whether it’s owning a car, using public transportation, or occasional ride-hailing services, getting from point A to B efficiently is vital. Transport connects us to work, errands, and relationships. I budget for fuel, repairs, and transportation passes so that mobility is never a stress point.

Food

Food is both a need and a joy, but in the “must-have” section, I focus on nourishment. Grocery bills, home-cooked meals, and essential supplements go here. Dining out occasionally is fine, but my main focus is ensuring I’m well-fed with quality nutrition on a daily basis.

2. The Middle Layer: SHOULD HAVE

Once the must-haves are covered, I move on to expenses that contribute to personal growth and stability. These are important, but not urgent. They enhance life in meaningful ways and set the stage for long-term success.

Education

Learning never stops. Whether it’s an online course, buying books, attending My Money Pyramid workshops, or subscribing to platforms that teach new skills, I regularly invest in my personal development. I see education as a tool for both career growth and mental enrichment. It’s one of the most rewarding long-term investments.

Subscriptions

We live in a digital age where subscriptions offer tremendous value—if used wisely. I subscribe to services that support my learning, productivity, and well-being. That includes cloud storage, content streaming (within limits), and tools that support my professional goals. I regularly review my subscriptions to eliminate wasteful spending and keep only what adds value.

Clothes

Clothing isn’t just about fashion; it’s about function and confidence. In the “should-have” category, I prioritise versatile, high-quality pieces over trendy, disposable My Money Pyramid fashion. Clothes that last longer, fit well, and serve multiple purposes help reduce spending in the long run.

3. The Top Layer: COULD HAVE

At the top of the pyramid lie the discretionary expenses—the nice-to-haves. These are things that I enjoy but can live without if needed. This layer is flexible, and I only indulge when the base and middle layers are fully taken care of.

Entertainment & Lifestyle Perks

Going to the movies, treating myself to a spa day, weekend getaways, or buying the latest tech gadgets all fall under this category. They bring joy, but they don’t define my happiness. When I splurge, it’s intentional and guilt-free, knowing my essential bases are covered.

Gifts and Social Spending

This includes buying gifts for family and friends, donations, and social outings. I allocate a small portion of my income each month to be generous when occasions My Money Pyramid arise. It’s wonderful to give, but never at the cost of financial strain.

Putting It All Together

Using this pyramid helps me make spending decisions faster and with more confidence. It answers critical questions like:

- “Do I really need this right now?”

- “Is this helping me grow or just a temporary thrill?”

- “Is there a more valuable way to use this money?”

Whenever I receive income—whether from a salary, side gig, or windfall—I use this framework to distribute it. I typically follow this allocation structure:

- 50% to Must-Haves

- 30% to Should-Haves

- 20% to Could-Haves

Of course, these percentages can shift depending on life circumstances, but they serve as a general guide.

Emergency Buffer: The Invisible Layer

Though it’s not shown explicitly in the pyramid, I also believe in keeping an emergency fund that covers 3 to 6 months’ worth of Must-Have expenses. This invisible buffer acts as a shock absorber for life’s uncertainties—job loss, health emergencies, or sudden repairs. It’s peace of mind in financial form.

Final Thoughts

Money is not just a tool for survival or luxury—it’s a reflection of what we value. By structuring my spending through the Money Pyramid, I’ve learned to align my financial habits with my priorities. The result? Less stress, more confidence, and a deeper sense of control over my life.

Whether you’re new to budgeting or looking to refine your strategy, try building your own pyramid. Customize the layers based on your values, goals, and lifestyle. Remember: it’s not about being strict, but about being intentional.