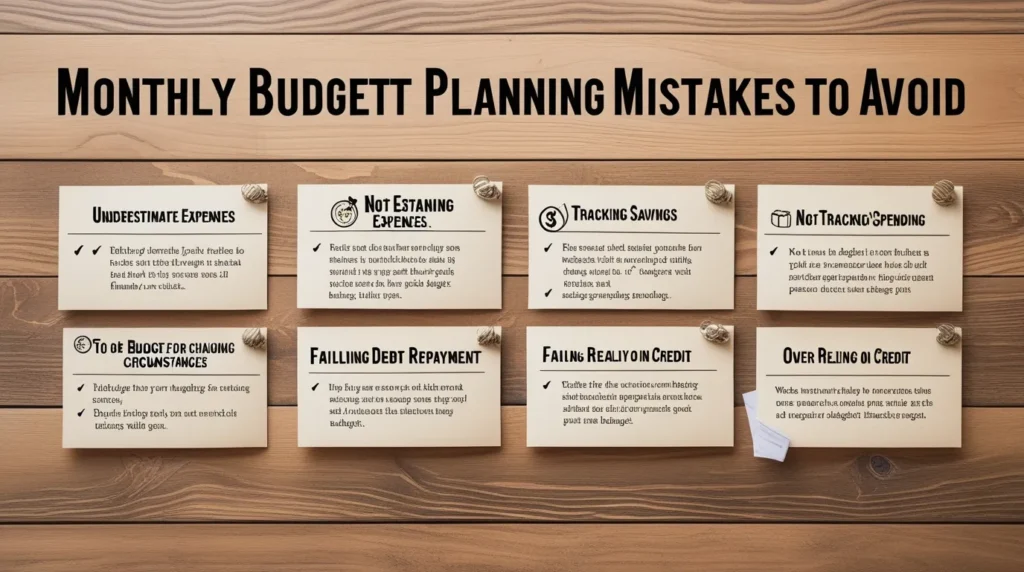

Monthly Budget Planning Mistakes

A budget is the foundation of financial health, acting as a roadmap for your money. However, a poorly constructed or maintained budget is often worse than no budget at all, leading to frustration, overspending, and the eventual abandonment of the entire process. Success in budgeting doesn’t come from being a finance wizard; it comes from avoiding common pitfalls and being honest and realistic about your spending habits. By addressing these mistakes, you can create a practical, sustainable budget that truly serves your financial goals.

Common Budgeting Mistakes and How to Avoid Them

1. Not Tracking Your Actual Expenses (The Silent Killer)

Many people create a budget based on estimates or guesswork rather than historical data, leading to instant failure.

- The Mistake: Guessing how much you spend on variable categories like groceries, dining out, or gas. This also includes ignoring “invisible” small, daily purchases (the $5 coffee, the $10 delivery fee) that drain your account unnoticed.

- The Fix: Track Everything & Be Honest

- The Audit: For at least one month, track every single expense to get a realistic, accurate picture of your spending baseline. Review bank and credit card statements—don’t rely on memory.

- Account for Small Leaks: Include a category for “miscellaneous” or “fun money” to cover those small, impulse purchases. Acknowledging them prevents the budget from collapsing over small, unaccounted-for amounts.

2. Omitting Irregular or Non-Monthly Expenses

A monthly budget should account for expenses that occur quarterly, annually, or seasonally, otherwise, a sudden bill will destroy your month’s plan.

- The Mistake: Forgetting large, periodic expenses like annual insurance premiums, property taxes, car registration, holiday gifts, or even semi-annual medical checkups.

- The Fix: The Annualized Fund

- Calculate the Monthly Share: Identify all non-monthly expenses for the year. Divide the annual total by 12.

- Create a Sinking Fund: Set aside that calculated amount each month into a separate savings account (a “sinking fund”). When the expense is due, the money is already there, protecting your monthly cash flow.

3. Setting Unrealistic Goals and Being Too Restrictive

A budget that demands extreme sacrifice right away is a fast track to burnout and failure.

- The Mistake: Trying to cut back on every category drastically (e.g., slashing a $700 grocery budget to $300 overnight) or cutting out enjoyable spending entirely. This leads to binge spending and quitting the budget.

- The Fix: Start Small and Include “Fun”

- Be Realistic: Base your new limits on your actual tracked spending (from Mistake #1), trimming only 10-20% at a time.

- Budget for Joy: Include a dedicated “fun fund” or “personal spending” category. Allowing yourself guilt-free spending money within limits makes the budget sustainable.

4. Not Making Savings a Non-Negotiable Expense

Many people treat savings as what’s left over at the end of the month, which is often nothing.

- The Mistake: Waiting until the end of the month to save. When unexpected expenses or impulsive wants arise, savings are often the first thing to be sacrificed.

- The Fix: Pay Yourself First & Automate

- Mandatory Line Item: Treat savings (for retirement, investments, and your emergency fund) as a fixed expense, just like rent or a loan payment, and budget for it first.

- Automation: Set up automatic transfers to your savings and investment accounts to happen immediately after your paycheck is deposited. If you don’t see the money, you won’t spend it.

5. Assuming Your Budget is Static

A “set it and forget it” approach ignores the dynamic nature of life, making the budget irrelevant over time.

- The Mistake: Treating your initial budget document as a permanent fixture. Life changes—income increases, rent goes up, you change jobs, or you adopt a new habit—and an unadjusted budget quickly becomes useless.

- The Fix: Schedule Regular Reviews

- Monthly Review: Set a recurring reminder (e.g., on the 1st of every month) to review your actual spending against your planned budget.

- Adjust and Refine: Use this review time to adjust categories that were consistently over- or underestimated. This periodic fine-tuning keeps your budget accurate and effective.

6. Ignoring the Emergency Fund

Neglecting to plan for the inevitable emergencies that will arise forces you to rely on high-interest debt when disaster strikes.

- The Mistake: Not allocating a portion of your income specifically to building a financial safety net for things like medical bills, car repairs, or sudden job loss.

- The Fix: Prioritize Your Buffer

- Budget for the Fund: Create an Emergency Fund as a mandatory monthly saving category until you have 3-6 months of living expenses saved in a separate, easily accessible account.

- Contingency: For less severe emergencies, consider adding a small monthly “Contingency” or “Unexpected” buffer to your monthly spending plan.

Final Thoughts

Successful monthly budgeting isn’t about restriction; it’s about clarity, intentionality, and control. By correcting these common mistakes—getting accurate spending data, planning for the big but rare costs, remaining realistic and flexible, and making savings automatic—you move from constantly reacting to your money to proactively directing it. Embrace the process, be patient with yourself, and remember that a successful budget is one you can actually stick to.