Financial Independence in 5 Simple Steps

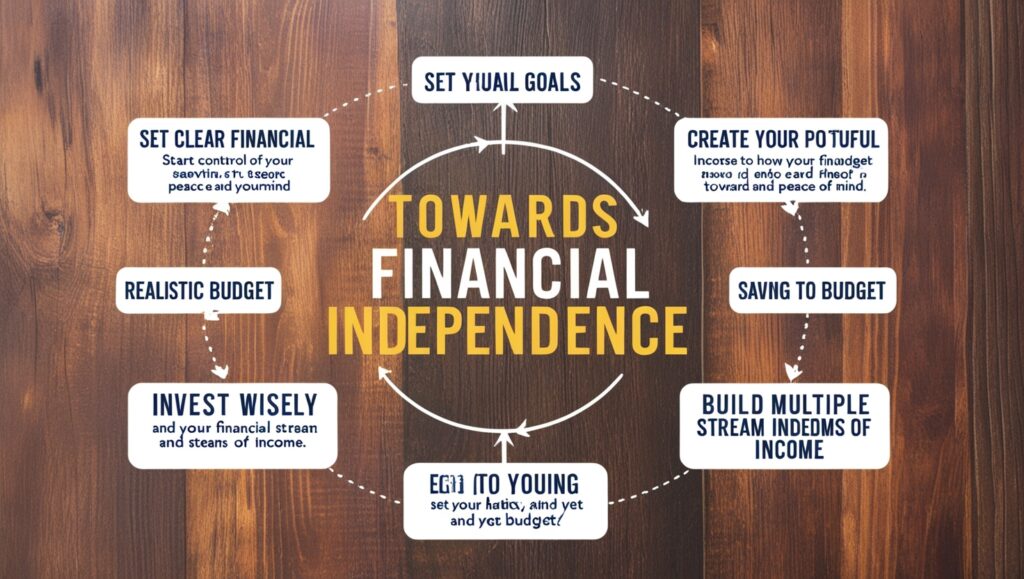

Achieving financial independence is a dream for many. It’s the freedom to live life on your terms, free from the constraints of paycheck-to-paycheck living. While it may seem daunting, financial independence is within reach if approached with careful planning and dedication. Financial Independence in 5 Simple Steps Here’s a step-by-step guide to help you embark on this transformative journey.

Step 1: Define Your Financial Goals

The foundation of financial independence lies in knowing what it means for you. For some, it’s retiring early; for others, it’s pursuing passions without monetary concerns. Start by setting clear, specific goals:

- Short-term goals: Paying off a credit card or saving for a vacation.

- Medium-term goals: Saving for a home or a significant life event.

- Long-term goals: Retirement or financial security for your family.

Write these goals down and assign a timeline. This clarity will guide your financial decisions and keep you motivated.

Step 2: Create and Stick to a Budget

A budget is your roadmap to financial independence. It helps you understand where your money is going and ensures you’re saving enough to meet your goals.

- Track your expenses: Use apps or spreadsheets to categorize spending.

- Differentiate needs vs. wants: Focus on necessities like housing, food, and transportation, and minimize discretionary spending.

- Adopt the 50/30/20 rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

Sticking to a budget requires discipline, but the rewards are immense as you watch your savings grow.

Step 3: Eliminate Debt Strategically

Debt can be a significant roadblock on the path to financial independence. Prioritize paying off high-interest debts like credit cards while managing lower-interest debts such as student loans.

- Debt snowball method: Pay off the smallest debts first to build momentum.

- Debt avalanche method: Focus on debts with the highest interest rates to save money over time.

Consider consolidating debts or negotiating better terms with creditors to speed up repayment.

Step 4: Build and Diversify Your Investments

Savings alone won’t lead to financial independence; investing is essential for growing your wealth. Start small and expand as you learn.

- Emergency fund: Save 3–6 months’ worth of expenses in a high-yield savings account.

- Stock market: Invest in index funds, ETFs, or individual stocks based on your risk tolerance.

- Real estate: Explore rental properties or REITs for steady income.

- Retirement accounts: Maximize contributions to 401(k)s, IRAs, or other retirement plans, especially if your employer offers matching contributions.

Remember, time in the market is more critical than timing the market. Begin as early as possible to benefit from compound interest.

Step 5: Cultivate a Financially Savvy Mindset

Financial independence isn’t just about money—it’s about mindset. Develop habits and attitudes that support long-term success.

- Continual learning: Read books, attend seminars, and follow financial experts to expand your knowledge.

- Lifestyle inflation control: Resist the urge to increase spending as your income grows.

- Stay disciplined: Stick to your plan even during setbacks or market downturns.

- Multiple income streams: Explore side hustles, freelance work, or passive income opportunities to boost earnings.

The Benefits of Financial Independence

Reaching financial independence brings countless benefits:

- Freedom to pursue passions and interests without financial stress.

- Greater security and peace of mind for you and your family.

- Opportunities to give back to your community or invest in causes you care about.

Final Thoughts

Financial independence is a journey, not a sprint. By defining your goals, managing your finances wisely, eliminating debt, and investing for the future, you can achieve a life of freedom and fulfillment. Financial Independence in 5 Simple Steps Each step builds upon the last, creating a solid foundation for a prosperous future.

Start today. Every small action you take moves you closer to the life you envision. Financial Independence in 5 Simple Steps Financial independence isn’t just a dream—it’s a reality waiting to be achieved with dedication and smart planning.